The Forex market is a specific financial market that trades over-the-counter. This means that there is no centralised exchange involved in the settlement of Forex transactions, like in the case of the stock market, and Forex market participants trade more or less directly with each other. There are certain benefits with over-the-counter markets such as Forex, including the ability to trade around the clock as the market doesn’t depend on the open market hours of a centralised exchange.

Most active Forex times

Even though the Forex market is open around the clock, not all trading hours are the same in terms of activity, volatility, and liquidity. Forex traders need to take this into account when placing their trades, as lower liquidity in the market can cause slippage and widen the transaction costs (spreads) of a currency pair.

Before we dig deeper into the best time of day to trade Forex, let’s take a look at how the Forex market operates.

The Forex market trades during Forex trading sessions, which are located in major financial centers around the world, including New York, London, Paris, Frankfurt, Moscow, Tokyo, Singapore, and Sydney. Out of these financial centers, four are considered as major trading centers for the Forex market, which are New York, London, Tokyo, and Sydney.

The open market hours for each trading session are shown in the following table:

Spring/summer times (March/April – October/November)

|

LOCAL TIME |

EDT |

BST (GMT+1) |

|

Sydney Open – 7:00 AM Sydney Close – 4:00 PM |

5:00 PM 2:00 AM |

10:00 PM 7:00 AM |

|

Tokyo Open – 9:00 AM Tokyo Close – 6:00 PM |

8:00 PM 5:00 AM |

1:00 AM 10:00 AM |

|

London Open – 8:00 AM London Close – 4:00 PM |

3:00 AM 11:00 AM |

8:00 AM 4:00 PM |

|

New York Open – 8:00 AM New York Close – 5:00 PM |

8:00 AM 5:00 PM |

1:00 PM 10:00 PM |

Fall/winter times (October/November – March/April)

|

LOCAL TIME |

EST |

GMT |

|

Sydney Open – 7:00 AM Sydney Close – 4:00 PM |

3:00 PM 12:00 AM |

8:00 PM 5:00 AM |

|

Tokyo Open – 9:00 AM Tokyo Close – 6:00 PM |

7:00 PM 4:00 AM |

12:00 AM 9:00 AM |

|

London Open – 8:00 AM London Close – 4:00 PM |

3:00 AM 11:00 AM |

8:00 AM 4:00 PM |

|

New York Open – 8:00 AM New York Close – 5:00 PM |

8:00 AM 5:00 PM |

1:00 PM 10:00 PM |

As you can see, wherever you’re located, you can trade the Forex market around the clock during different Forex trading sessions. When the New York session is closed, the Asian session is open, and vice-versa.

However, not all trading sessions have the same characteristics. The London session is usually the most active session of all, given the large number of international banks located in London. Since the London and New York sessions overlap for a few hours each day, this NY-London overlap increases the liquidity of Forex pairs even more, which lowers transaction costs and adds to price movements in the market. Scalpers, for example, may find the New York-London overlap to be the best time to place their short-term trades.

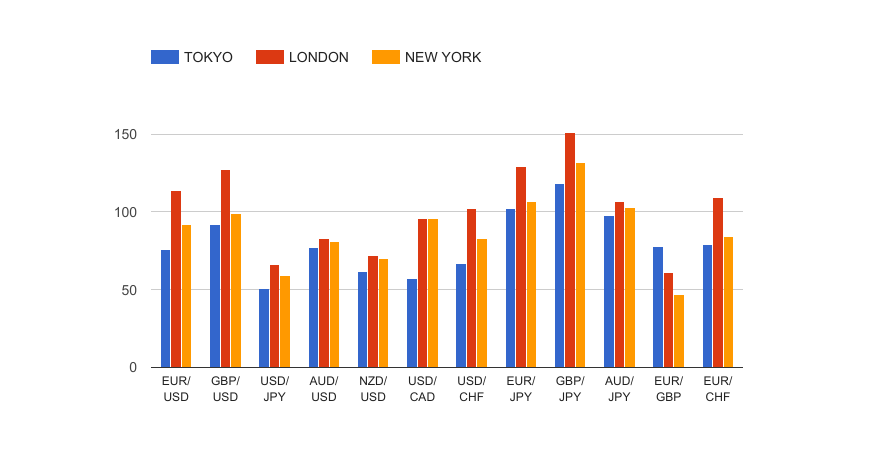

The chart above shows the average volatility in pips for different currency pairs during major trading sessions. As you can see, the London session usually has the highest volatility.

Best days to trade Forex

Besides trading hours, Forex traders should also pay attention to their trading days. This is especially important for day traders, but becomes less important for longer-term traders such as swing and position traders. Day traders usually close their trades by the end of the trading day, or leave it open for a day or two, which makes the trading day an important consideration for day traders. Swing traders, on the other hand, hold their trades from a few days to a few weeks, which makes the entry timing relatively less important compared to scalpers and day traders.

Nevertheless, all market participants could benefit from trading during the market's most active days. The Forex market is open Monday through Friday, and is closed on weekends. While Mondays and Fridays are usually slow, there can be significant movements on these days, especially if important market events happened over the weekend which may cause the market to open with a gap on Monday.

Similarly, many market participants who trade on a shorter-term close their trades on Friday, which could reverse the dominant trend during the week during late Friday trading due to these profit-taking activities.

Traders also need to follow a Forex calendar which lists important market releases during the week. Usually, Mondays and Fridays don’t have important releases (except the US non-farm payrolls which are released each first Friday of the month). Important central bank meetings also happen most of the time between Tuesday to Thursday.

What is the best time to trade Forex?

As you can see, the best time to trade Forex depends on your trading goals and trading style. Scalpers would find the best times to be those with increased market activity and liquidity, which lowers transaction costs. Day traders would like to trade on those days which offer the largest price swings, and be cautious when trading on Fridays since profit-taking activities can reverse familiar price directions.

Best hours to trade Forex

If we had to pick only one time of the day to trade the market, that would undoubtedly be the New York-London overlap, which starts at 1:00 PM GMT with the open of the New York session, and ends at 4:00 PM GMT with the close of the London session.

These trading hours have not only the highest liquidity, but also the highest volatility, as a lot of important market reports are released during these hours. For example, US reports are usually scheduled during the US mornings, which happens to be between 1:00 PM GMT and 4:00 PM GMT. Even though higher liquidity usually lowers price volatility, the sheer amount of buying and selling power during the New York-London overlap tends to cause large price swings every single day.

Currencies and trading sessions: what and when to trade

Another important aspect of Forex trading sessions is knowing which currencies to trade during which trading sessions. Again, this is important for scalpers and day traders, as they hold their trades for a relatively short period of time compared to swing and position traders.

In essence, currencies such as the Australian dollar and New Zealand dollar are less traded than other majors, such as the US dollar, euro, and British pound. The Sydney session, for example, could increase the liquidity for AUD pairs compared to other sessions. Bear in mind that the NY-London overlap can be used to trade any currency pair.

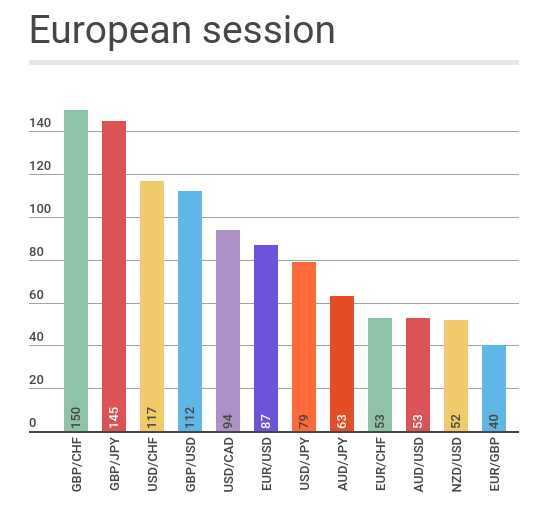

The European session, including centers such as London, Paris, and Frankfurt, offers the largest volatility not only for European currencies, but also for other major pairs and cross-pairs. The British pound vs Swiss franc pair – both European currencies – has the largest average volatility during the European session. However, this cross-pair is less liquid than other pairs, which magnifies its volatility.

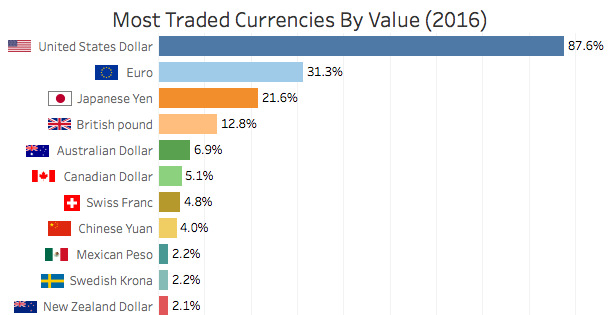

Major pairs, which are pairs that consist of the US dollar and one of the remaining seven major currencies, are usually highly-traded during all Forex trading sessions. Bear in mind that the US dollar is the single most actively-traded currency on the market, with a market share of more than 80% of all Forex transactions.

Final words

Determining the best time to trade the Forex market is an important part of a trader’s trading strategy, especially for scalpers and day traders. There are many factors which influence the best hours to trade Forex: the currencies are you trading, your location, whether you are looking for lower transaction costs or higher volatility, whether you are a day trader or a swing trader, and so on.

The Forex market is an over-the-counter market which trades during Forex trading sessions, including the New York trading session, the London trading session, the Sydney trading session, and the Tokyo trading session. The Asian trading session actively trades Asian currencies, such as the Japanese yen, Australian dollar, and New Zealand dollar. However, bear in mind that the New York and London sessions actively trade all major currencies, not only the US dollar and European currencies.

Typically, many traders will find the New York-London overlap to be the best time of day to trade the Forex market. The New York-London overlap starts at 1:00 PM GMT with the open of the New York session, and ends at 4:00 PM GMT with the close of the London session. Since these two trading sessions are individually also the most active sessions out of the four major sessions, their overlap creates an extremely high number of orders which can both increase the price volatility, and reduce transaction costs.