There are many techniques that Forex traders can use to trade the market and improve their trading strategy. One of the most powerful yet often neglected techniques is trading on Forex correlation. This is especially important for traders who trade more than one currency pair or want to build a portfolio of trades, in which case Forex correlation can significantly boost profitability and reduce market risk. In this article, we’ll cover everything you need to know about correlation between Forex pairs, and we’ll even raise it to the next level by introducing currency correlation on news releases. Although Forex correlation may sound complicated and intimidating at first, I assure you it’s pretty easy to incorporate in your daily trading routine once you understand the concept properly.

What is correlation?

Before we head into Forex correlation, we need first to explain what correlation means. Correlation is a statistical method which measures the interdependence between two or more variables. In other words, correlation measures how one variable will behave on the change of another variable.

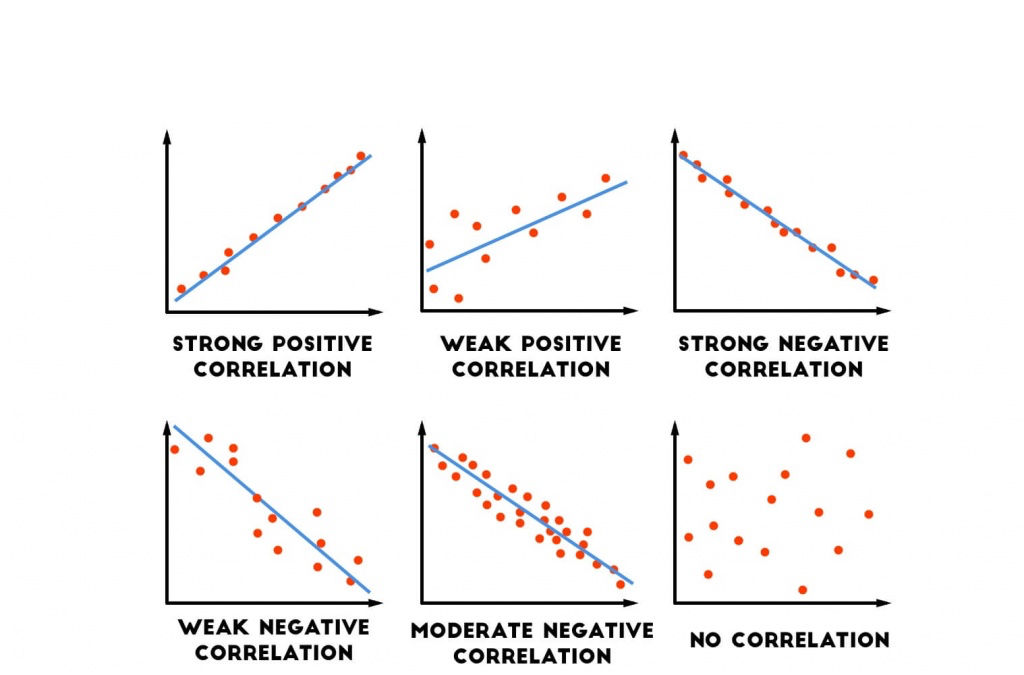

Correlation is expressed by the correlation coefficient, which can take a value of between -1 and 1. Basically, a correlation coefficient of -1 reflects a perfect negative correlation, meaning that if one variable rises, the other variable will fall to the same extent. A correlation coefficient of 1 is a perfect positive correlation, meaning that if one variable rises, the other will follow in equal measure. Finally, a correlation coefficient of 0 signals that there exists no meaningful statistical relationship between the two variables, i.e., they do not correlate in any way and move completely independently of one another.

Perfect negative and positive correlations are very rare. The correlation coefficient usually takes a value of higher than -1, and lower than +1. For example, a value of 0.5 signals that two variables are positively correlated, i.e., both will usually move in the same direction. Similarly, a correlation coefficient of -0.5 signals that two variables are negatively correlated and will usually move in opposite directions.

The following image shows what positive and negative correlations look like.

Correlation coefficients are calculated using mathematical formulas which ar beyond the scope of this article. For now, it’s important that you understand the underlying concept of correlations and correlation coefficients. To summarise this short introduction, correlation measures the interdependence between two variables, with the strength of the correlation expressed in the form of a correlation coefficient (-1 = variables move in opposite directions, +1 = variables move in the same direction, 0 = no significant relationship exists between the two variables).

How currency correlation works

Now that you know what correlation is and how it is measured, it’s time to see how it can be used when trading Forex. In this case, the two variables that are analysed for interdependence are the exchange rates of currency pairs. In a perfect correlation with a correlation coefficient of +1, two currency pairs will always move in the same direction and to the same extent. Similarly, a perfect negative correlation of -1 would indicate that two currency pairs will always move in opposite directions and to the same extent, i.e., if a pair rises 100 pips, the other pair will fall 100 pips, and vice-versa.

Obviously, there are extreme examples, and perfect positive and negative correlations simply don’t exist in Forex, or any other financial market. However, some currency pairs can come very close to a perfect correlation, as we’ll see later.

As you can see, knowing the correlation coefficients in the Forex market can help you improve your trading performance and reduce risk when trading. If you open a long position on two currency pairs which are strongly positively correlated with a correlation coefficient of between 0.5 and 1.0, you’re basically increasing your risk as both pairs will likely move in the same direction most of the time.

In the Forex market, we can identify three types of correlation:

1) Correlation between individual currencies

2) Correlation between currency pairs

3) Correlation based on macroeconomic (news) releases

In the following lines, we’ll cover all three types of Forex correlation.

Correlation between currencies

One of the most basic correlation types that any Forex trader should understand is between currencies. Two individual currencies can indeed exhibit a certain correlation due to their specific fundamental characteristics. To explain correlations between individual currencies, let’s first cover how they tend to behave during different market environments.

As you already know, there are eight major currencies which are traded on the Forex market: the US dollar, British pound, euro, Swiss franc, Canadian dollar, Australian dollar, New Zealand dollar, and the Japanese yen. Some of them tend to move in tandem while others move in opposite directions.

Risky currencies, such as the Australian dollar, New Zealand dollar and, to a lesser extent, the euro, tend to fall simultaneously in times of global economic and political turmoil. This is especially true for the Australian dollar and the New Zealand dollar. Similarly, when market participants show an increased appetite for risk, these currencies tend to appreciate. This characteristic makes them positively correlated currencies.

On the opposite side to risky currencies are the safe haven currencies, such as the Japanese yen, the Swiss franc and, to a lesser extent, the US dollar. These currencies tend to rise in times of economic and political uncertainty, which is why they’re called safe havens. Investors move their capital into these currencies in times of market stress, causing them to appreciate. Again, safe- haven currencies are mostly positively correlated currencies. But, safe haven currencies are most of the time inversely (or negatively) correlated to risky currencies.

To explain this concept even further, some of the mentioned currencies are also correlated to commodity prices, such as the Canadian dollar, the Australian dollar, and the New Zealand dollar. The Canadian dollar is strongly correlated to the price of oil, as Canada is a major oil producer. When oil rises, the Canadian dollar will most likely follow. The Australian dollar correlates to the price of iron ore and other natural resources which are major exports of Australia, similar to the New Zealand dollar. This makes these currencies positively correlated to commodities.

Correlation between currency pairs

While Forex correlation between currencies is important to understand, Forex traders often use Forex correlation matrix tables to analyse the correlations between various currency pairs. Since currencies are always quoted in pairs, it makes perfect sense to follow the correlation coefficients among pairs to trade the market and take advantage of their correlation.

At this point, it needs to be said that currency correlations constantly change over time. If a pair had a positive correlation previously, it doesn’t mean that the pair will continue to exhibit positive correlation in the future. In fact, the correlation can even change from positive to negative over time, although this happens very rarely.

Also, the correlation coefficients can change over different timeframes. While a pair can have a modest positive correlation on the 4-hour timeframe, that correlation can significantly strengthen over the weekly or monthly timeframe. The EUR/USD and USD/CHF pairs, for example, had an exceptional positive correlation of 0.95 back in early 2000. In other words, these two pairs were almost perfectly positively correlated, with 95% of all movements mimicked by the other pair. Since then, this highly positive correlation has changed but the pairs still move in the same direction most of the time.

Another good example are the GBP/USD and EUR/USD pairs. The GBP/USD pair paints the direction for the EUR/USD pair most of the time. If the first pair is rising, the second will follow soon, and vice-versa.

Which Forex pairs are correlated?

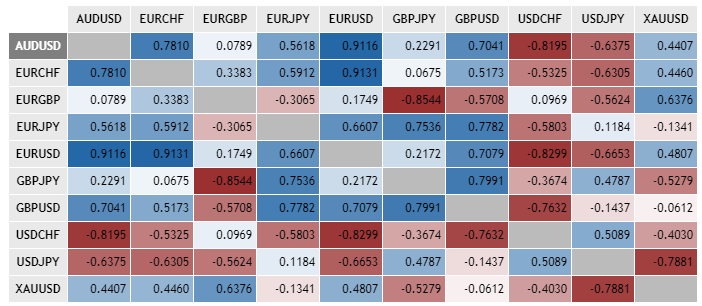

The following table shows the current correlation coefficients for the most traded currency pairs.

The table shows the correlation coefficients calculated from November 2012 to September 2018. As you can see, pairs that include the same currency as either the base or counter currency tend to have stronger correlations, which is no wonder given that the same fundamentals impact those pairs. EUR/USD and EUR/CHF have a very strong positive correlation of 0.91, while GBP/JPY and EUR/GBP exhibit a strong negative correlation of -0.85 (because the British pound is the base currency in one pair, and the counter currency in the second pair), making these pairs one of the best Forex correlation pairs. EUR/USD and AUD/USD also show a strong positive correlation of 0.91. This Forex pairs correlation table is also called a Forex matrix. Forex correlation tables should be looked up regularly, because the correlations can change over time. You can also use a Forex correlation calculator or a Forex pair correlation indicator to check the current correlations of Forex pairs.

Forex correlation based on macroeconomic news releases

Correlations can also be calculated for the impact of news releases on certain currencies. Forex traders who use a news trading strategy can benefit from this a lot; since these correlations tell how certain currencies behave after an important macroeconomic (or news) release is published. These findings are again influenced by the specific characteristics of currencies. For example, safe havens such as the Swiss franc tend to be less influenced by domestic Swiss macroeconomic releases, which is no wonder given that investors are looking for market stress in other parts in the world in order to invest in the Swiss franc. That’s why the Swiss franc has fairly loose correlations to domestic releases.

The British pound, on the other hand, shows the strongest positive correlation among European currencies between domestic macroeconomic releases and the value of the domestic currency. Again, the euro has unimpressive correlations with the release of European numbers. This can partly be explained with the way Eurostat reports major news. Usually, Eurozone countries such as Germany and France publish their reports before Eurostat (which has to collect data from all Eurozone countries first) and the exchange rates have already priced in the numbers way before Eurostat releases a combined report for the Eurozone.

In the research, I used the following market moving reports: monetary policy meetings regarding interest rates, changes in gross domestic product, changes in the unemployment rate, and changes in inflation rates. Basically, the research was based on collecting the actual and forecasted numbers for the mentioned releases for the last 10 years, after which the domestic currency movements were measured. Currencies that were part of the research are the British pound, the Swiss franc, and the euro.

The main findings are summarised in the following table:

|

Interest Rates |

GDP |

Unemployment Rate |

Inflation |

Deflation |

|

|

EUR |

|

|

|

|

|

|

Correlation Coefficient |

0,382 |

-0,07 |

-0,498 |

-0,542 |

0,584 |

|

Sample Size |

6 |

14 |

8 |

7 |

6 |

|

df (n-2) |

4 |

12 |

6 |

5 |

4 |

|

Method |

t-table |

t-table |

t-table |

t-table |

t-table |

|

t |

0,827 |

-0,243 |

-1,407 |

-1,442 |

1,439 |

|

p |

0,227 |

0,406 |

0,105 |

0,104 |

0,112 |

|

GBP |

|

|

|

|

|

|

Correlation Coefficient |

0,46 |

0,917 |

-0,694 |

0,909 |

- |

|

Sample Size |

5 |

12 |

6 |

9 |

- |

|

df (n-2) |

3 |

10 |

4 |

7 |

- |

|

Method |

r-table |

t-table |

t-table |

t-table |

- |

|

t |

- |

7,27 |

-1,928 |

5,77 |

- |

|

p |

- |

0,0000135 |

0,063 |

0,00034 |

- |

|

CHF |

|

|

|

|

|

|

Correlation Coefficient |

0,39 |

0,44 |

0,417 |

0,685 |

0,533 |

|

Sample Size |

4 |

9 |

5 |

8 |

9 |

|

df (n-2) |

2 |

7 |

3 |

6 |

7 |

|

Method |

r-table |

t-table |

r-table |

t-table |

t-table |

|

t |

- |

1,296 |

- |

2,303 |

1,756 |

|

p |

- |

0,118 |

- |

0,030 |

0,061 |

The findings in the table above show that the British pound had the strongest correlation with domestic reports on GDP and inflation rates. The pound had a 0.91 correlation coefficient with the change in GDP (when actual GDP differs from expected) and a 0.90 correlation coefficient with a surprise reading of the inflation rate (when the actual inflation rate differs from the expected). The euro had unimpressive results as the currency fell with lower than expected unemployment rates (-0.498 correlation coefficient), and with lower than expected inflation rates (-0.542). The interdependence with interest rates is positive, but not strong, across all three currencies, which can be partly explained by the fact that markets already factored in interest rate changes before they actually happened.

The Swiss franc, as expected, shows positive but not very strong positive correlations across the board. As we've previously stated, the Swiss franc is a safe haven and tends to be affected by other factors outside domestic macroeconomic reports.

Forex correlation between pairs

Forex correlation pairs strategies rely on the correlations among currencies, pairs, and macroeconomic releases to trade the market. Forex traders often use a Forex correlation indicator to stay up to date with current correlation coefficients of currency pairs and to build their strategy around it.

Basically, you don’t want to go long on two pairs that have highly positive correlation coefficients, as your market risk would increase simultaneously. Buying one lot of EUR/USD and one lot of AUD/USD will almost have the same effect as going long on two lots on EUR/USD, as these two pairs are positively correlated with a correlation coefficient of 0.91, i.e., they move in the same direction most of the time.

To build a strategy around correlations, you need to use these findings to your advantage. Build a portfolio of currency pairs that show no high positive or negative correlation between pairs. You can add EUR/USD, AUD/USD, and any other pairs in your portfolio, but the total portfolio should consist of variously correlated pairs so that you reduce your market risk. The best trade setups arise when two inversely correlated pairs both show a buy or sell setup, or when two strongly positive correlated pairs show opposite setups, i.e., one long and one short. In these cases, you can exploit the trades to the maximum and reduce your market risk because, if one setup doesn’t go in your favour, the other one likely will.

Conclusion

Forex currency pair correlation is an important topic that is often neglected not only by beginners, but also by advanced traders. Correlation is a statistical concept that measures the interdependence of two variables. Correlation is expressed with a correlation coefficient, which can take values of between -1 and +1. A correlation coefficient of -1 shows a perfectly negative correlation, i.e., the two variables move in opposite directions and to the same extent all of the time. Similarly, a correlation coefficient of +1 is a perfectly positive correlation, with the two variables moving the same direction and to the same extent all of the time. A correlation coefficient of 0 shows that no significant interdependence between the two variables exists.

Market correlation Forex trading involves being aware of the current correlations between currency pairs in order to take advantage of them by reducing your trading risk. In the Forex market, there are three major correlations that you need to be aware of: correlation between individual currencies, correlation between currency pairs and correlation between currencies based on macroeconomic releases.

Make sure to fully understand these concepts if you want to trade on Forex correlations. Reading the e-book titled “Forex correlation strategy pdf” can provide you with more detail regarding Forex correlations, which can help you build your first portfolio of currency pairs that will boost your trading performance and reduce your risk.